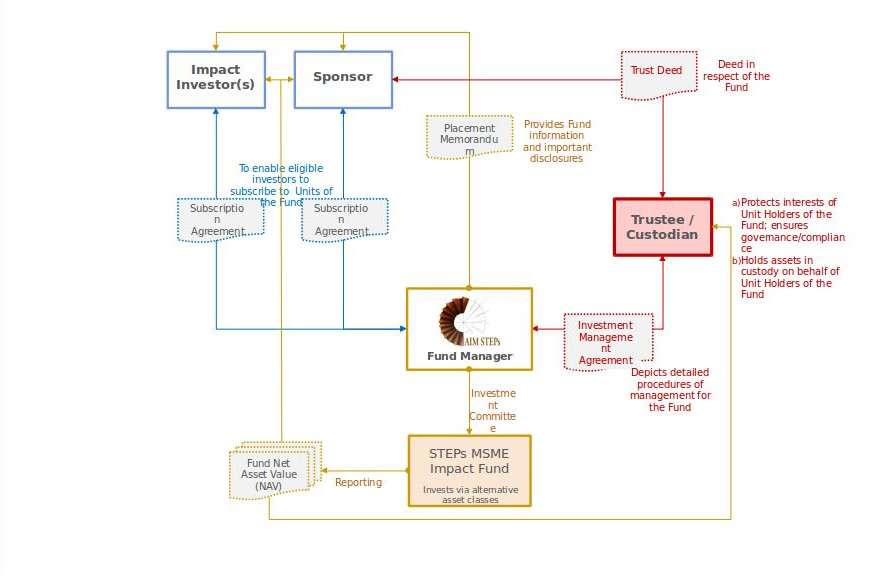

AIM STEPs utilizes a consortium approach to engineer financial inclusion for the micro, small and medium enterprises (MSMEs) primarily in non-urban areas. The financing options are sought by entrepreneurs who demonstrate a track record in managing their business and associated financing requirements, but fall short of the traditional banking requirements, e.g. financial records, credit rating etc..

Leveraging our partner organizations’ distribution network and using a technology enabled proprietary platform to record and store periodic data across operational, transactional and financial performance we screen for potential MSME investees.

We have a distribution footprint across 25 districts in Bangladesh with c. 100 Field / Marketing Agents working via a hub & spokes model. Our database of potential MSME investees is growing daily (and already includes detailed information on 10,000+ MSMEs across our nationwide network).

Current profile of investees includes dairy farmers (some with bio-gas digester modules), fisheries, handicrafts, handlooms and livestock entrepreneurs who face barriers in accessing finance from traditional financing entities. AIM STEPs encourages growth in these small industries as they promote a sustainable rural economy and simultaneously lays the foundation for transformative progress in their daily lives and future generations.